After military service, the most patriotic thing you can do as a wealthy person is pay your taxes. – Mark Cuban

HVUT is the Heavy Vehicle Use Tax that is a fee assessed annually on heavy vehicles operating on public highways at registered gross weights equal to or exceeding 55,000 pounds. The gross taxable weight of a vehicle is determined by adding the weight of the Truck, Trailer and load.

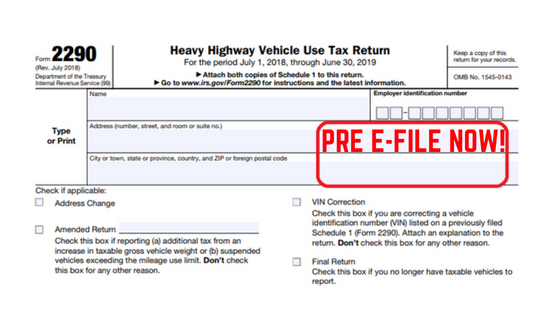

Heavy Vehicle Use Taxes must be filed using the Form 2290 Annually. The Tax period for Heavy Vehicles begins on July 1st and ends on June 30th of the following year. The annual renewal of your Form 2290 for a new tax period IS DUE BY August 31st each year. Continue reading