Tax payers reporting tax on a Highway motor truck can make IRS tax payments in three different ways

Tax payers reporting tax on a Highway motor truck can make IRS tax payments in three different ways

Electronic payment options are convenient, safe, and secure methods for paying taxes or user fees to the IRS. Taxpayers can authorize an electronic funds withdrawal, use a credit or debit card or enroll in the U.S. Treasury’s Electronic Federal Tax Payment System (EFTPS)®. IRS is the only authorized body to debit your account or process for tax payments.

Electronic payment options give taxpayers an alternative to paying taxes or user fees by check or money order. Payments can be made 24/7. The electronic funds withdrawal and EFTPS options are free!!!

Features and Benefits of Electronic Funds Withdrawal:

- It’s convenient. Taxpayers and business filers can e-file and e-pay in a single step.

- It’s free. Although there are no service charges for using the payment option, please check with your financial institution about any fees it may charge.

- It’s safe and secure. Payment information will be used only for the tax payment(s) authorized by the taxpayer. No unauthorized withdrawals will be made.

- Bank account information is safeguarded along with other tax information.

- Payment information will not be disclosed for any reason other than for processing the transaction authorized by the taxpayer.

- For Form(s) 720 and 2290 the electronic payment will be effective (i.e., settled) on the date the return or form is e-filed with the IRS.

- After the return due date, the effective date for EFW payments will be the date the return or form was successfully transmitted.

How to Make an Electronic Funds Withdrawal Payment:

- This payment option is available at www.TaxExcise.com.

- Upon selection of the electronic funds withdrawal option, a payment record will display for entry of payment information

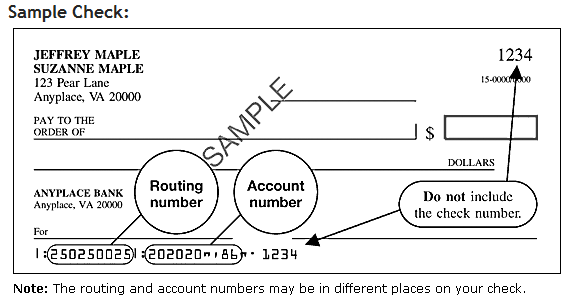

Routing Transit Number: Taxpayers must know their financial institution’s routing transit number. The first two digits of the routing number must be 01 through 12 or 21 through 32. On the sample check below, the routing number is 250250025.

Name of the Bank: Taxpayers must be aware of the Bank name from where the tax amount has to be debited.

Bank Account Number: The account number can be up to 17 digits. Omit hyphens, spaces, and special symbols. Enter the number from left to right and leave any unused boxes blank. On the sample check below, the account number is 20202086. Do not to include the check number.

Type of Account: Taxpayers must identify the type of account from which the payment is to be made (checking or savings). The type of account can either be savings or checking. Many credit unions don’t allow an electronic funds withdrawal from a savings account. Please check with your financial institution for further details.

- Taxpayers must know their financial institution’s routing transit number and account number.

- Taxpayers must identify the type of account from which the payment is to be made (checking or savings).

- The routing transit number and account number are usually located at the bottom of checks and share drafts.

- Taxpayers should check with their financial institution regarding questions on these numbers and to confirm that the financial institution will allow an electronic withdrawal from the specified account. The majority of rejected payments are due to issues with the routing transit number and/or account number.

Note: Electronic funds withdrawals cannot be initiated after the return or form is filed.

Facts You Need to Know:

- This transaction authorizes the U.S. Department of the Treasury (through a Treasury Financial Agent) to transfer the specified payment amount from the taxpayer’s bank account to the Treasury’s account.

- “IRS USA Tax Payment,” “IRS USA Tax Pymt,” or something similar is listed on a taxpayer’s monthly bank statement as proof of payment.

- Funds are withdrawn on the payment date selected. However, if a weekend or bank holiday is designated, the payment will not be withdrawn until the next business day.

- The payment amount will be withdrawn in a single transaction. No recurring or partial withdrawals will be made.

Cancellations, Errors and Questions:

- Once the IRS e-file return is accepted, information pertaining to the payment, such as the account information, payment date or amount, cannot be changed. If changes are needed, the only option is to cancel the payment transaction and choose another payment method.

- Taxpayers should call the Treasury Financial Agent, Customer Service, at 1-888-353-4537, toll-free, to cancel a payment or to report problems such as bank closures, lost or stolen bank account numbers, closed bank accounts or unauthorized transactions. Customer Service is available 24 hours a day, 7 days a week.

- Scheduled payments can be cancelled up to 8:00 p.m. local time, two (2) business days before the scheduled payment date. The cancellation must be authorized by the taxpayer.

- Taxpayers may also call 1-888-353-4537 to inquire about payments but should wait at least 7 – 10 days after the e-file return is accepted before calling.

- Taxpayers will be notified if a payment is returned by the financial institution due to insufficient funds, incorrect account information, closed accounts, etc. If this occurs, the IRS will send a notification letter to the address on record explaining why the payment could not be processed. The letter will provide alternative options for making the payment. For questions regarding the letter, please call 1-888-353-4537.

- In the event the financial institution is unable to process the transaction, the taxpayer will be responsible for the tax payment and for any penalties and interest incurred.

- Contact the IRS immediately at 1-800-829-1040 if there is an error in the amount withdrawn.

- In the event Treasury causes an incorrect amount of funds to be withdrawn from a bank account, Treasury is responsible for returning any improperly transferred funds.

Note: Once a return is transmitted and got stamped from IRS, the Taxpayers have to reach IRS for any clarification on payments. The Software prepare will not hold responsibility for any delay in transaction.

Call our Support Center [HELP DESK] at 1-866-245-3918 for any queries or write to us at support@taxexcise.com, At taxexcise.com we are always happy to help you through your filing process.