When a new vehicle is put into service, the Form 2290 must be filed by the last day of the following month. If a vehicle was used during any part of a month, the tax will be calculated for that month as a whole. For example, if a vehicle was first used on the road on April 15th, it will be taxed as though it was used the entire month. If you first placed your vehicle on the road anytime in April, you must file your Form 2290 anytime before May 30th, 2017.

‘Prevention is better than cure’ is one of the oldest phrases that we hear from time to time. In business when it comes to financial matters, it is important to keep records of all transactions as a precaution; be it small or a big transaction. The sole and the most important reason to perform business activities is to earn profit; increase the zeros in our bank accounts. At the same time, we want to make sure that no mistakes or problems occur while earning those hard earned dollars for IRS or anybody else to snatch it away from us. Hence we need a good record keeping system that can actually help you save money. Keeping records to maintain the progress of our business is just as important. As per the IRS, Keep records of all your Excise taxes for at least 3 years after the date the tax is due or paid, whichever is later. They must be available at all times for inspection by the IRS. When it comes to tax 2290, it is important to maintain records for the following reasons:

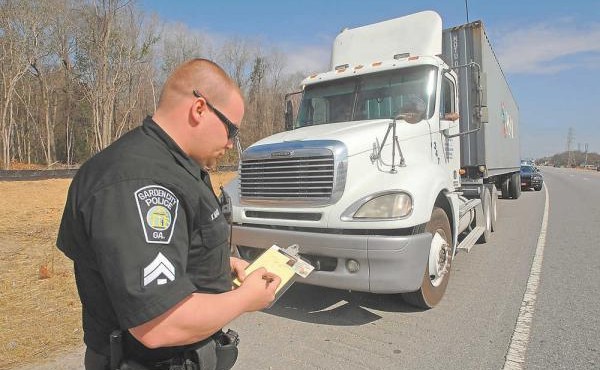

‘Prevention is better than cure’ is one of the oldest phrases that we hear from time to time. In business when it comes to financial matters, it is important to keep records of all transactions as a precaution; be it small or a big transaction. The sole and the most important reason to perform business activities is to earn profit; increase the zeros in our bank accounts. At the same time, we want to make sure that no mistakes or problems occur while earning those hard earned dollars for IRS or anybody else to snatch it away from us. Hence we need a good record keeping system that can actually help you save money. Keeping records to maintain the progress of our business is just as important. As per the IRS, Keep records of all your Excise taxes for at least 3 years after the date the tax is due or paid, whichever is later. They must be available at all times for inspection by the IRS. When it comes to tax 2290, it is important to maintain records for the following reasons:  Most of the drivers get nervous when they see the flashing lights of a police car on their rear view mirror. Of course, who would like to get pulled over when we are rushing towards our destiny? You like it or not it’s mandatory to show the officer that you are cooperating. The next second those lights come on, make sure that you are being observed and the way you react will decide whether you are going to end up in a problem or not.

Most of the drivers get nervous when they see the flashing lights of a police car on their rear view mirror. Of course, who would like to get pulled over when we are rushing towards our destiny? You like it or not it’s mandatory to show the officer that you are cooperating. The next second those lights come on, make sure that you are being observed and the way you react will decide whether you are going to end up in a problem or not.