Taxpayers who must file Form 2290, Heavy Highway Vehicle Use Tax Return, have more time to do so this year. That said, the deadline will be here before they know it. Taxpayers must file their 2019 Form 2290 by Tuesday, September 3. Normally, the due date is August 31. However, this year the weekend and a federal holiday extended the 2019 date.

Anyone who has registered or is required to register a heavy highway motor vehicle must file Form 2290. While some taxpayers who file this form are required to do so electronically, all 2290 filers can file online. These taxpayers can use their credit or debit card to pay the Heavy Highway Vehicle Use Tax.

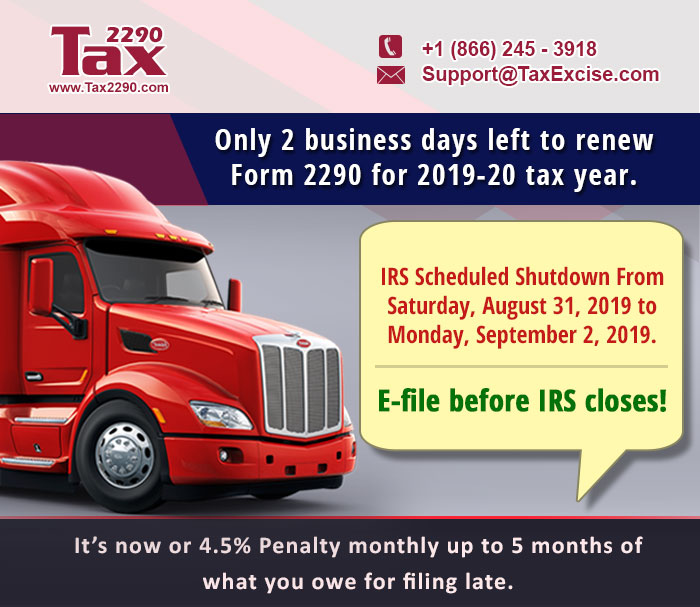

IRS will conduct its annual Labor Day power outage beginning Saturday, August 31, 2019, starting at 7:00 p.m. and ending Tuesday, September 3, 2019, at 7:00 a.m. September 3 is also the Due Date for reporting the Federal Heavy Vehicle Use tax Form 2290. During the downtime IRS will not be operational and will not process any tax return. You just have few hours before the scheduled Down Time.

Filing Form 2290 electronically helps speed up the return of an IRS-stamped Schedule 1 to the taxpayer as proof of payment. Taxpayers need Schedule 1 for state registration. We’re working on all the days till September 3, 2019 to help you through your 2290 eFiling. Talk to us or email us for your questions. Live Chat for instant help is also available.

Taxpayers with questions can call and talk to our Help Desk at 866 245 3918 for IRS Form 2290 Help Line. It is available between 8 a.m. and 8 p.m. EST: