Hello, truckers! Every trucker needs to navigate through the complexities of Form 2290 HVUT filing to keep their heavy vehicles rolling on public highways. Reporting Form 2290 to the IRS is the key to fulfilling your yearly tax obligations and ensuring smooth trucking operations. Generally, Form 2290 truck taxes are paid in advance during the beginning of the tax season every July, and the tax period lasts till the end of next June. Therefore, the new tax period for this tax year, 2024-2025, has started, and it is high time you filed your Form 2290 HVUT returns to the IRS to continue your trucking operations. The deadline to report your truck taxes is quickly approaching. So, you must act soon and report Form 2290 and get the IRS-stamped Schedule 1 copy within the deadline.

There are two ways to report your truck taxes to the IRS: paper filing and electronic filing. In the paper filing method, you need to either mail your Form 2290 tax reports to the IRS or directly visit the IRS office and file your tax reports. In the electronic filing method, you need to E-file form 2290 through an IRS-approved form 2290 E-filing service provider.

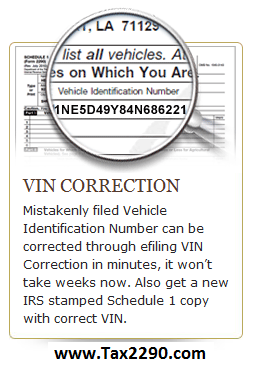

When you have Vehicle identification numbers (VIN) of up to 17 characters with mixed numbers and letters, mistakes happen. For example, you type 5 instead of S. Let’s say that you file form 2290 and pay $550 to IRS and get your Schedule 1 you take it to the DMV or the Carrier, and then you realize that the Schedule 1 has the wrong VIN. What do you do?

When you have Vehicle identification numbers (VIN) of up to 17 characters with mixed numbers and letters, mistakes happen. For example, you type 5 instead of S. Let’s say that you file form 2290 and pay $550 to IRS and get your Schedule 1 you take it to the DMV or the Carrier, and then you realize that the Schedule 1 has the wrong VIN. What do you do? There are lot things a trucker has to check on his heavy truck before he could hit the road. We all know preparation is the key to success, once the truck hits the highway the driver is all by himself. It’s always good to have a check list so that he can stay out of trouble. Few important things include Change of Oil and filter it needed. The Tires need a complete inspection before your journey begins, it needs to be checked for wear and tear and pressure as well. All the fluid levels have to be checked, brake fluid, coolant, power steering fluid, transmission fluid and washer fluid too. If the checks show low levels, have the truck serviced.

There are lot things a trucker has to check on his heavy truck before he could hit the road. We all know preparation is the key to success, once the truck hits the highway the driver is all by himself. It’s always good to have a check list so that he can stay out of trouble. Few important things include Change of Oil and filter it needed. The Tires need a complete inspection before your journey begins, it needs to be checked for wear and tear and pressure as well. All the fluid levels have to be checked, brake fluid, coolant, power steering fluid, transmission fluid and washer fluid too. If the checks show low levels, have the truck serviced.