Dear taxpayers, may we have your attention, please!

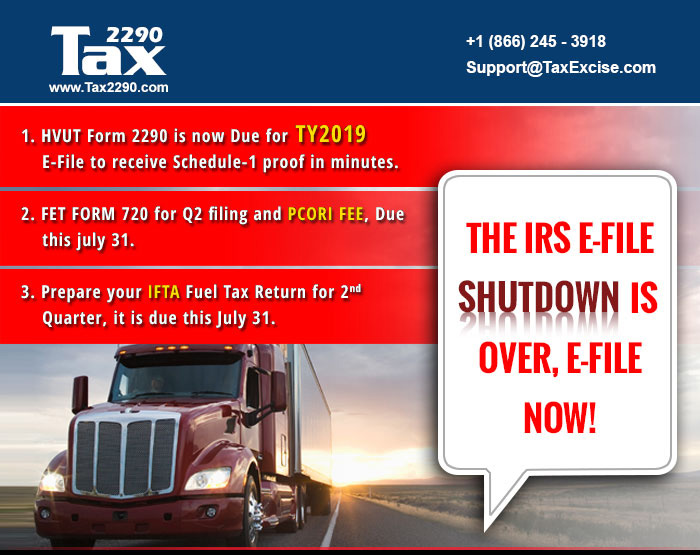

The IRS e-file service is back online and processing tax returns electronically now, any returns filed through www.TaxExcise.com / www.Tax2290.com now will process instantly within minutes. Our Tax Experts are just a phone call away to assist with your Form 2290 and Form 720 e-filing, Reach us @ (866) 245 – 3918 for assistance.

Forms that are due this month:

Tax Form 2290:

Since this is your HVUT Form 2290 renewal time of the year again, your entire fleet is due for renewal for the tax period beginning July 1, 2019, through June 30, 2020. Your vehicle tags and registrations are also due for renewal this month, which means you immediately need to submit your tax return electronically to the IRS to receive your Stamped Schedule-1 copy in your email (& Fax, if opted), as a proof of payment.

Tax Form 720:

This is a quarterly Federal Excise Tax, filed every 3 months and is due now for the Quarter ending June 2019. PCORI that is filed only annually on the Q2 filing is also due this month-end. Indoor Tanning Taxes is one among the most used category reported electronically on Form 720. Which means you immediately need to submit your tax return electronically to the IRS which will be instantly accepted by the IRS and we will send you the receipt acknowledgment, all within minutes.

WE

RECOMMEND e-filing your tax returns, That being said, another great reason to

e-file your tax return TODAY is the DISCOUNTED FEE with a FLAT 10% discount

code “SAVE10”.

All the

above-mentioned Tax Forms can be e-filed by simply logging on to the www.taxexcise.com / www.tax2290.com website and follow the prompt

for a successful filing. Also, our tax experts are just one ring away from

answering any questions you might have in regards to your filings. Rest

assured, our Tax Experts would never let you go wrong!

Call us or

write to us at 1-866-245-3918 / support@taxexcise.com

for any suggestion and queries. You can also ping us on LIVE CHAT for

assistance.