Truckers and other owners of Heavy Highway Vehicles now have until Nov. 30 to file Form 2290,Heavy Highway Vehicle Tax.

Truck Tax 2290 due Nov 30

The tax is scheduled to expire on Sept. 30, 2011, and the extension will alleviate any confusion if Congress reinstates or modifies the tax.

Related links:

- www.Tax2290.com/irsalert

- http://www.TaxExcise.com/irs

- Trucking Tax Center

- IR-2011-77, IRS Gives Truckers Three-Month Extension; Highway Use Tax Return Due Nov. 30

We are closely working with the IRS and please call our Support Center at 1-866-245-3918 or write to us at support@TaxExcise.com for any further information. We are happy to support you through with latest communication received from the IRS.

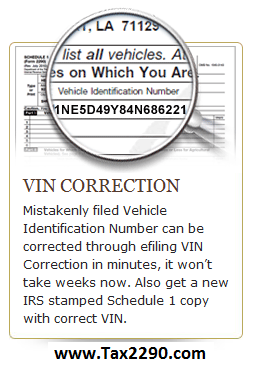

IRS Form 2290 Amendments:

IRS Form 2290 Amendments:

Trucks are use as the preferred mode of transportations across states in USA. The people rely deeply on the trucking business to convey and transport the merchandises that make every day existence reachable, making truck drivers the fortitude of the present American economic system. Trucking jobs are a good way to make a decent income and to provide your family needs.

Trucks are use as the preferred mode of transportations across states in USA. The people rely deeply on the trucking business to convey and transport the merchandises that make every day existence reachable, making truck drivers the fortitude of the present American economic system. Trucking jobs are a good way to make a decent income and to provide your family needs.