With just a day away from 2020, its time to say goodbye to the old year and welcome the New Year with brightness and joy.

In honor of the New Year 2020, we want to take a moment and thank you all for your continued support. With a journey of a decade behind us, you have helped make each year better than the last. We look forward to continue doing business with you in the year ahead. At the end of the day our customers are the single most important part of everything we do, we value your business and wish you..

Happy New Year to all our customers, partners, friends and families. Here’s to 2020!!! 🍾🥂

New Year promises to be an exciting and busy time for all of us. With so much going on this holiday season, there is just too little time for us to be prepared for the upcoming tax deadlines that begins from January 2020. So we bring you this blog to help you get organized for the month in advance:

- Form 2290: January 31st, 2020 is the Deadline to E-file your Federal Excise Tax Form 2290 for Vehicles first used in the Month of December 2019 since July 2019.

- Form 720: Federal Excise Tax Form 720 for the Fourth Quarter of 2019 is due by January 31st.

- IFTA: International Fuel Tax Agreement (IFTA), for the Fourth Quarter of 2019 is also due by January 31st.

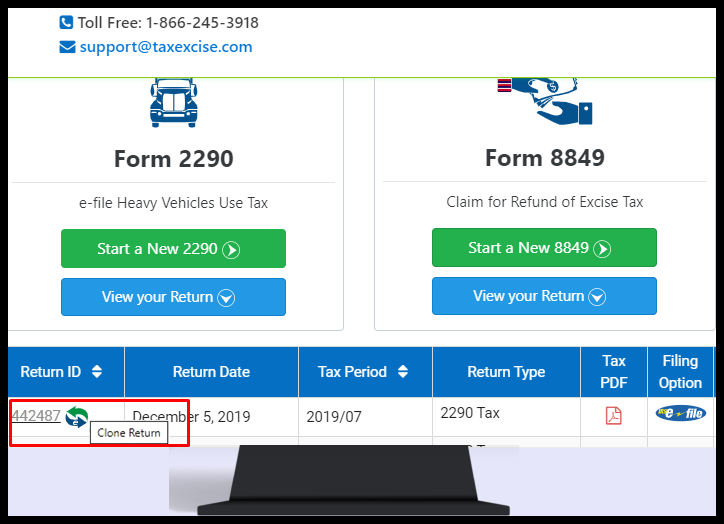

E-file through www.Taxexcise.com / www.Tax2290.com to avoid complicated tax calculations and confusing tax Jargon’s.

Important E-filing Notice: The IRS e-file system is currently shut down beginning Thursday, December 26, 2019 for year-end maintenance and will not be available until they open for e-filing in January 2020. The IRS hasn’t announced the opening day for e-filings but they are usually operational from early-to mid-January.

You can still e-file your tax returns using our website during the Business shut down, we’ll hold your return and transmit it to the IRS when they open for e-filing. But if you need the acknowledgments during the shutdown, we suggest you to paper file your tax returns instead.

The IRS may not be available to assist you during the shutdown period but Taxexcise.com and its Tax Experts will be available to assist you even during the Production cutover time. Feel free to reach our Team @ 1-866-245-3918 or write to us in support@taxexcise.com or ping them using the LIVE CHAT option available on the website.

Important information for all our CPA customers:

Preparer tax identification number (PTIN) applications and renewals for 2020 are now being processed by the IRS.

All the CPAs who are e-filing federal tax returns for clients must have a valid 2020 PTIN before preparing returns. All enrolled agents must also have a valid PTIN.

PTIN Renewal or First-time PTIN applicants can obtain a PTIN online from the link https://rpr.irs.gov/. But if you prefer to use the paper option, use Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application (PDF). Contact the PTIN helpline for PTIN related questions.

We are always interested in suggestions that would allow us to improve upon our already high standards and encourage you to submit your thoughts here: https://g.page/Tax2290/review

Happy and Safe Trucking!