![]() Tax payers reporting tax on a Highway motor truck have only three options to choose to make IRS tax payments

Tax payers reporting tax on a Highway motor truck have only three options to choose to make IRS tax payments

![]() Tax payers reporting tax on a Highway motor truck have only three options to choose to make IRS tax payments

Tax payers reporting tax on a Highway motor truck have only three options to choose to make IRS tax payments

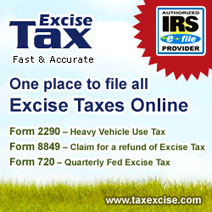

File Excise Taxes @ www.taxexcise.com

WASHINGTON — IRS e-file has reached a major milestone as it passed the one billion mark for individual tax returns processed safely and securely since 1986.

The Internal Revenue Service’s electronic filing program started as a pilot project in 1986 and became available nationally in 1990. Prior to the April 18 deadline, IRS e-file passed another high point as more than 100 million individual tax returns were e-filed during the 2011 filing season. Continue reading

Excise Tax e-File & Compliance (ETEC) Programs – Form 720, Form 2290 and Form 8849

Excise Tax e-File & Compliance (ETEC) Programs – Form 720, Form 2290 and Form 8849

The Excise Tax e-File project was initiated to satisfy the IRS’ requirement to provide electronic filing of Form 2290,Heavy Highway Vehicle Use Tax Return, as directed in the American Jobs Creation Act (October 2004). Excise Tax e-File & Compliance (ETEC) Programs (Form 720, 2290 and 8849) has joined the ever-growing-number of tax forms and schedules that can be electronically filed, providing taxpayers the speed and reliability that millions of taxpayers and business owners already enjoy. www.TaxExcise.com offers simple, easy and quick website to file all these excise tax form electronically with IRS. Efile, It’s as easy as 1-2-3!!! Continue reading

When reporting an original Form 2290, Heavy Motor Truck Tax with IRS for the tax year, you would have changed some information like VIN, Gross Weight, Mileage Limit then IRS wants you to file amendments to the originally filed form 2290. There are three types of amendments available for form 2290

When reporting an original Form 2290, Heavy Motor Truck Tax with IRS for the tax year, you would have changed some information like VIN, Gross Weight, Mileage Limit then IRS wants you to file amendments to the originally filed form 2290. There are three types of amendments available for form 2290

For a vehicle that will be used within 5,000 miles or less (7,500 miles or less for agricultural vehicles) during the period, it can be reported as a suspended/exempt vehicle from tax liability. Continue reading

IRS Form 2290 is to figure and pay the Heavy Vehicle Use Tax [Truck Tax] to the IRS. By efiling form 2290 it is possible to get Schedule-1 in minutes. To efile a IRS form 2290, you need to have the following tax details ready

IRS Form 2290 is to figure and pay the Heavy Vehicle Use Tax [Truck Tax] to the IRS. By efiling form 2290 it is possible to get Schedule-1 in minutes. To efile a IRS form 2290, you need to have the following tax details ready

Business Name, EIN [Employer Identification Number], VIN [Vehicle Identification Number, Gross Weight…

Vehicle Identification Number:

The Vehicle Identification Number (VIN) is a distinctive number assigned to a vehicle to identify it for changing title, vehicle registration and other functions. It contains 17 digits of alphanumeric characters.

VIN Correction:

When you have Vehicle identification numbers of up to 17 characters with mixed of numbers and letters, mistakes happen. For example, You type 5 instead of S. To err is human.

For Example, Let’s say that you file form 2290 and pay $550 to IRS and get your Schedule-1. You take it to the DMV or the Carrier, then you realize, that the Schedule 1 has the wrong VIN. Then need to report 2290 Amendment for VIN correction.