In an era when smartphones and tablets have taken over, filing tax returns through paper is slowly going extinct and completing tax returns online is the need of the hour as it is easier, precise and efficient. The less complicated your tax return is, the more rudimentary is the preparation for it.

The slight panicky feeling that happens when deadlines approach and start to accumulate is every tax payer’s worst nightmare. These tax deadlines happen once every year or every quarter and failure to address them results in penalties and interest from Uncle Sam.

It’s time now to put on your thinking hat and have these tax returns completed in order to stay compliant with the IRS. A Few Tax forms that are Due this month would namely be:-

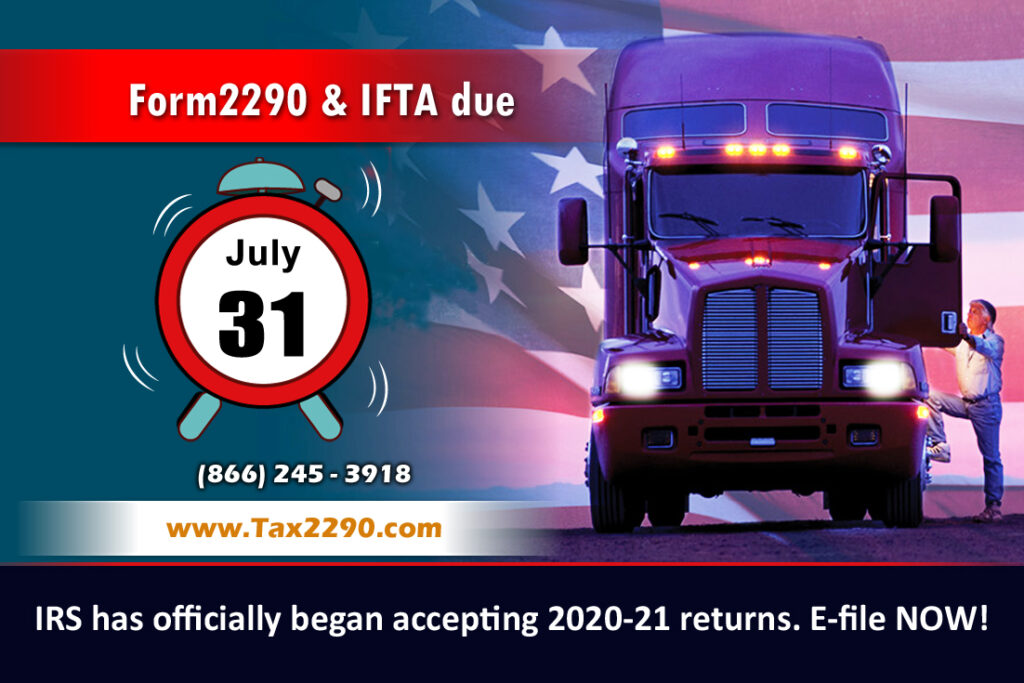

- Form 2290: The Federal Excise Tax Form 2290 also known as Heavy Vehicle Use Tax (HVUT) is due for renewal for the current 2020 tax year. And the deadline to report any new Vehicles first used in the month of June is due by July31st.

- IFTA: International Fuel Tax Agreement is due by July 31st for the second quarter of 2020.