Hello, truckers! Tax2290.com wishes you a merry Christmas and a happy new year. This year has been another incredible one for us, and we would like to thank you for helping us reach this milestone. We will work towards making your form 2290 tax e-filing more fantastic through our innovation, technology, and development.

Tag Archives: Form 2290 Amendments

Start with your 2290 HVUT reporting for 2019-20 Tax Year Today

Tax2290.com the IRS authorized and certified website is the most experienced electronic filing service provider and top rated website. Every heavy vehicles operated on the public highway falls due for 2290, the federal vehicle use tax reporting. Electronic filing is the best, safe and fastest way to get it done and receive back the watermarked Schedule 1 proof of payment.

Tax2290.com helps you file your 2290 tax returns right by prompting right questions to fill in your details that are required to report in HVUT form. The step by step approach makes your electronic filing experience a breeze. When you have questions you can get it clarified with our support desk or with our live chat agent or through an email. We’re waiting to support you through your filing process. The straight forward pricing helps you pay what you see and no hidden charges or no transaction fee.

Continue readingDue Date for Form 2290, an Overview!

When a new vehicle is put into service, the Form 2290 must be filed by the last day of the following month. If a vehicle was used during any part of a month, the tax will be calculated for that month as a whole. For example, if a vehicle was first used on the road on April 15th, it will be taxed as though it was used the entire month. If you first placed your vehicle on the road anytime in April, you must file your Form 2290 anytime before May 30th, 2017.

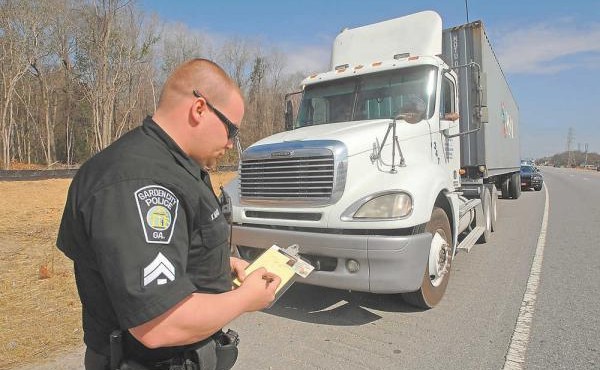

Do’s & Don’ts When You Get Pulled Over !

Most of the drivers get nervous when they see the flashing lights of a police car on their rear view mirror. Of course, who would like to get pulled over when we are rushing towards our destiny? You like it or not it’s mandatory to show the officer that you are cooperating. The next second those lights come on, make sure that you are being observed and the way you react will decide whether you are going to end up in a problem or not. Continue reading

Most of the drivers get nervous when they see the flashing lights of a police car on their rear view mirror. Of course, who would like to get pulled over when we are rushing towards our destiny? You like it or not it’s mandatory to show the officer that you are cooperating. The next second those lights come on, make sure that you are being observed and the way you react will decide whether you are going to end up in a problem or not. Continue reading

E-file 2290 Amendments in minutes with Tax2290.com

None of us can claim that we are Mr. / Mrs. Perfect and none will deny this fact. Mistakes are part and parcel of life, it happens with everyone and can happen even when we file our taxes. No matter if we file Our Federal Excise Tax Form 2290 by paper or Online, mistakes do happen. It’s what you do to correct the mistakes done on your Form 2290 filing matters.

Your options are open, same as filing for your original Form 2290 you may either choose to Paper file your Form 2290 Amendments which is even more confusing than the original Form 2290 or can act smart by joining hands with technology by E-filing your Form 2290 amendments. Yes, the IRS has gifted you with the option to correct your mistakes committed on Form 2290 by Filing form 2290 Amendment. As always www.tax2290.com the First ever IRS authorized E-file Service Provider, Supports E-filing for Federal Excise tax Form 2290 Amendments.

Three Types of Amendments that you can E-file: Continue reading