We all make mistakes, have struggles, and even regret things in our past. But you are not your mistakes, you are not your struggles, and you are here NOW with the power to shape your day and your future. Brilliant Quote that suits everyone, nobody is error free and cannot claim that he/she has ever committed a mistake.

We all make mistakes, have struggles, and even regret things in our past. But you are not your mistakes, you are not your struggles, and you are here NOW with the power to shape your day and your future. Brilliant Quote that suits everyone, nobody is error free and cannot claim that he/she has ever committed a mistake.

Though E-filing Federal Excise tax Form 2290 is simple & straight forward, one can still commit few minor errors while trying to complete it in a hurry. A mistake once committed is committed & there is no point in simply cribbing about it. One must be brave enough to admit his/her mistake, smart and strong enough to correct them.

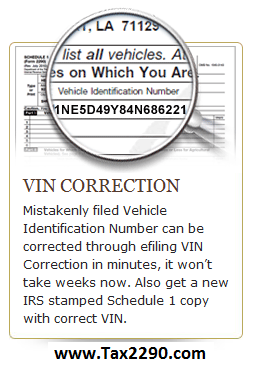

IRS is well aware of the fact that Mistakes does happen and also have gifted E-filers with a solution to correct them. There are three such errors that commonly happen when one tries to file Form 2990 that can be corrected by E-filing Tax Form 2290 Amendment. Continue reading