Does Santa use a reindeer or a truck? We believe that our truckers are Santa Clauses in disguise. This holiday season with Christmas around the corner we would like to appreciate the trucking community who would be spending this busy season in making millions of families happy, after all the best gift around the Christmas tree is the presence of family wrapped in love, we at Taxexcise.com would like to wish our Santa’s a Very Merry Christmas.

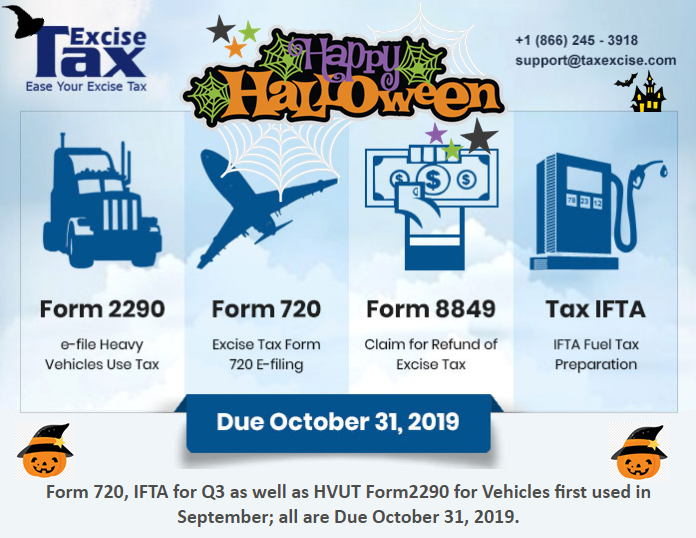

And we would also like to remind you to not miss out on the December 31st deadline for any new vehicles first used in November.

We also hope that you are aware that just after Christmas the IRS will be shutting down operations for a routine maintenance, so be sure to file your 2290’s before their downtime.

The IRS E-file Servers will be shut down for Year-End Maintenance every year by Christmas to prepare their systems for the upcoming Tax Year’s Filing. The IRS has posted it on their official website www.irs.gov that the MeF Production Shutdown/Cutover is scheduled to begin at 11:59 a.m., Thursday, December 26, 2019, to prepare the system for the upcoming 2020 Filing Season.

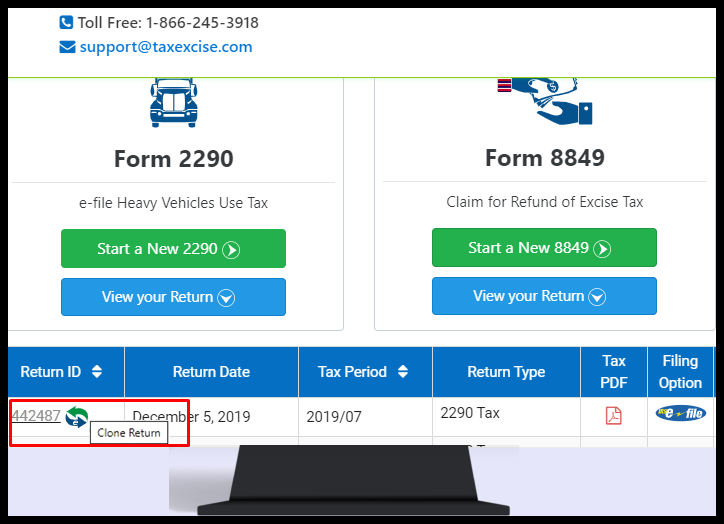

During the Shutdown period, the IRS will not accept or process any E-filed tax return. Though the IRS servers will be down, www.Taxexcise.com / www.Tax2290.com – Product of ThinkTrade Inc., will continue to accept tax returns. The tax returns that are filed during the Shutdown/Cutover time will be held securely on our servers and will be submitted to the IRS once their Servers are up and running, which is expected ONLY by the first week of January 2020.

Truckers, Trucking Companies & Tax Preparers who have returns to file for the Month of December are advised to E-file their Heavy Vehicle Use Tax Form (HVUT) Form 2290 before Christmas Weekend so that you won’t be bothered by the E-file Shutdown.

The IRS may not be available to assist you during the shutdown period but Taxexcise.com and its Tax Experts will be available to assist you even during the Production cutover time. Feel free to reach our Team @ 1-866-245-3918 or write to us @ support@taxexcise.com or ping them using the LIVE CHAT option available on the website.