Halloween is not only meant for Kids, Says www.Taxexcise.com & www.Tax2290.com – Products of ThinkTrade Inc. Kids have their own way of celebrating Halloween and we as the FIRST EVER AND THE ONLY DECADE OLD IRS Authorized E-file Service Provider For E-filing Heavy Highway Vehicle Use tax (HVUT) Form 2290, wish to Treat the Ever Busy and Hard working Trucking Community in our own style by offering a Special Discount this Halloween.

ThinkTrade Inc offers a Flat 10% OFF on the E-file Preparation Fee this Halloween with a Special discount code “HALLOWEEN17” valid only for two days that is 30th & 31st of October. Offer is valid on all the Three Tax Forms that must be filed before Halloween Ends i.e. 31st of October, 2017.

Taxes that are due tomorrow: Continue reading

We are half way through October which means we are close to Heavy Highway Vehicle Use Tax (HVUT) Form 2290 Due Date for Heavy Vehicles First used in the Month of September 2017 since July 2017. Any Heavy Vehicle with a gross weight of 55,000 lbs or above must have a Form 2290 filed for it on or before the end of the following Month to the Month First it was first used on Public Highways.

We are half way through October which means we are close to Heavy Highway Vehicle Use Tax (HVUT) Form 2290 Due Date for Heavy Vehicles First used in the Month of September 2017 since July 2017. Any Heavy Vehicle with a gross weight of 55,000 lbs or above must have a Form 2290 filed for it on or before the end of the following Month to the Month First it was first used on Public Highways.

“We all learn lessons in life. Some stick, some don’t. I have always learned more from rejection and failure than from acceptance and success”- Henry Rollins. Great things happen to those who don’t stop believing, trying, learning, and being grateful. Accept it or not we all have faced rejections in our lives, be it personal or professional. Reasons and circumstances may vary but what makes you a great human being is how you react when you face a rejection.

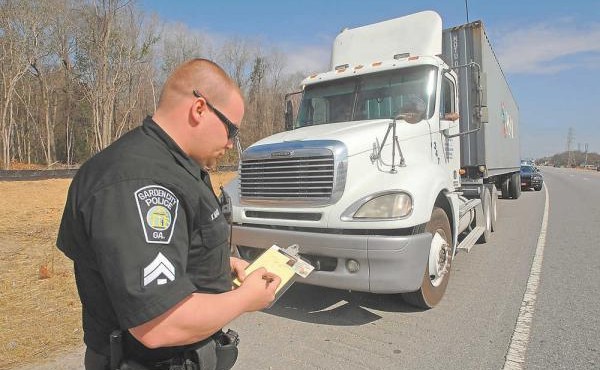

“We all learn lessons in life. Some stick, some don’t. I have always learned more from rejection and failure than from acceptance and success”- Henry Rollins. Great things happen to those who don’t stop believing, trying, learning, and being grateful. Accept it or not we all have faced rejections in our lives, be it personal or professional. Reasons and circumstances may vary but what makes you a great human being is how you react when you face a rejection. Most of the drivers get nervous when they see the flashing lights of a police car on their rear view mirror. Of course, who would like to get pulled over when we are rushing towards our destiny? You like it or not it’s mandatory to show the officer that you are cooperating. The next second those lights come on, make sure that you are being observed and the way you react will decide whether you are going to end up in a problem or not.

Most of the drivers get nervous when they see the flashing lights of a police car on their rear view mirror. Of course, who would like to get pulled over when we are rushing towards our destiny? You like it or not it’s mandatory to show the officer that you are cooperating. The next second those lights come on, make sure that you are being observed and the way you react will decide whether you are going to end up in a problem or not.